London is an exciting and vibrant city with endless possibilities. Find out how much it costs to live in London, from the cost of a pint to how much you’ll pay for a one-bedroom flat.

As one of the world’s leading global cities, London is especially culturally diverse and provides its inhabitants with plenty of entertainment, dining, and career advancement opportunities.

For these reasons, as well as English being the main language, it is a popular city for expats from all over the world.

If you are thinking about making the big move to the UK’s capital city, you are in for a grand adventure!

There are many things to consider upon moving to a new country such as where to live, finding a job, and legal requirements.

You will also need to consider the cost of living.

London is known to be one of the most expensive cities in the world to live in, so it is likely that you will need to make some adjustments to your budget upon moving to the ‘Big Smoke”.

Here we will provide a detailed look at the cost of living in London, and what you can expect your monthly expenses to look like.

Cost of Property Prices (to Buy or Rent)

If you are thinking about moving to London, then you are probably aware that it is among the most expensive cities in the world to rent.

It is not uncommon for Londoners to spend half of their monthly salary on rent.

The average monthly rent for a 2-bedroom property is around £2,400, and the average cost to purchase a 3-bedroom home is £967,989.

But do not let this discourage you.

While it does take patience and research, and maybe some compromise, it is still possible to find something in your price range in an area that suits your needs.

Figuring out what is most important to you when looking for a home can help save you money.

For example, a flat located right next to a Tube station will cost more than one that is a 15-minute walk away.

If you work from home and will not be commuting multiple times a day, it could save you quite a bit of money not having a Tube station so easily accessible.

If you are single or do not have a family, you can also drastically cut the cost of your monthly rent by renting a room in a flatshare.

SpareRoom, Ideal Flatmate, and Spotahome are helpful for searching for a shared house.

As with any city, property prices can vary greatly depending on which area of London you are in.

South London, for example, generally has lower rental prices than the other regions in London, with rent for a 1-bedroom flat averaging £1,456 per month.

This is quite different from the same flat in Chelsea leasing for £2,244 per month.

If you work in Central London and want to be near your office, as well as the busy city center, you can expect to pay £2,000 for a 1-bedroom apartment.

No matter where you are renting, it is likely that you will be required to pay a monthly fee for renter’s insurance.

This typically costs anywhere from £6 to £15 per month.

Anyone over the age of 18 who rents or owns a home in the United Kingdom is also required to pay the Council Tax.

If you are an international student, a full-time student of any kind, or meet other exemptions you do not have to pay the monthly tax.

The Council Tax depends on the size and value of your home but you should expect to pay at least £80 per month.

To determine your Council Tax you can use a Council Tax calculator.

Cost of Grocery & Food

Food and groceries are no exception to London’s high cost of living.

Grocery and food costs will differ from person to person depending on your eating habits.

Shopping at Sainsbury’s, Lidl, or Tesco rather than upscale grocery stores can save you money every week.

A combo meal at a fast-food restaurant will cost about £6, while a cappuccino is around £3.

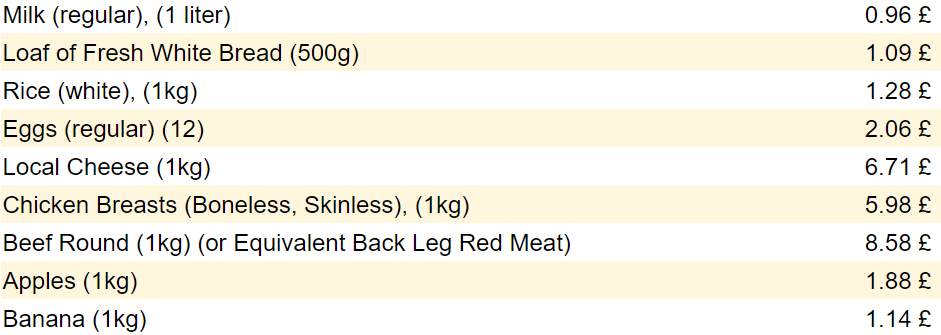

Take a look below for Numbeo’s average grocery costs:

Dining out can end up costing a lot (more on that below), especially for a family.

So, many Londoners save money by eating healthy meals consisting of chicken breasts and vegetables, and by taking their work to lunch.

Cost of Entertainment (Bars, Pubs, Restaurants, Cinema & Theatres)

If you choose to eat out more often than cooking, a single person at a casual, inexpensive restaurant can expect to pay £11 to £20 per meal.

For weekends or special occasions, a meal at a mid-range restaurant ranges from £20-£40.

Keep in mind that a pint of beer is typically £5, and a cocktail £12.

It is common for nightclubs to charge a cover fee, but you can save some money by getting there early, usually before 11 pm.

Cinema tickets to international releases can cost anywhere from £10 to £15.

Although, if you do your research, you can find great cinemas with cheaper admission such as Prince Charles Cinema and PeckhamPlex.

For free entertainment, visit museums and parks, and surf the internet for free events in the city.

Cost of Monthly Utilities

Gas, electricity, water, and wifi are all services to budget for in addition to your monthly rent.

You will likely pay a fixed monthly fee based on the average amount spent the past 12 months.

Thames Water is the city’s only water provider, and you can sign up for their services on their website.

The average monthly cost for gas, electricity, and water is around £160.

You can help cut heating costs by turning down your heating when you are not home and wearing more clothes to stay warm instead of running.

Depending on your provider and the package you chose, wifi will cost around £20-40 per month.

You can choose your own provider to use for electricity, gas, and wifi.

Money Super Market and uSwitch are energy comparison websites to help you choose the utility company.

Cost of Transportation

Whether you are driving, taking public transportation, or cycling, you will also have to factor transportation costs into your budget.

For use of public transportation, most commuters are using an Oyster Card, a monthly travel card, or their contactless bank card for payment.

The Oyster Card is good for almost every single mode of public transportation in London.

If you will be using public transport often, it is highly recommended that you use one of these forms of payment; if you purchase a single ticket every time, you can end up paying double.

The Oyster Card works with a pay-as-you-go system. The more you move around London, the more you pay.

You can always top off your Oyster Card with more money at one of the machines in the stations.

Both types of Oyster Cards have a daily cap, which means that once you reach a specific credit limit on your rides, the rest of the rides will be free.

Note: Peak fares apply to all travel made Monday-Friday before 9:30 am.

If you will be using a personal car for your daily commute, you are obligated to pay a Congestion Charge.

This is a daily charge of £11.50 for driving a vehicle in the charging zone Monday-Friday between 7:00 and 18:00.

The price of gasoline fluctuates daily, but the average is around £1.30 per lt.

The average ride in one of London’s famous black cabs will cost anywhere from £10-35 depending on distance and time of day.

If you prefer to commute by bicycle, there are a few biking services open to the public.

Santander Cycles is one of several cycling services you can choose from.

With Santander bikes, you pay £2 for 24 hours. You can make as many journeys as you want as long as they are under 30 minutes. If a journey exceeds 30 minutes, there will be an additional £2 charge.

If you sign up for a membership, you pay £90 and have unlimited access for a year. This equals about 25p per day.

Students in London can get 25% off their membership fee.

Cost of Sports & Activities

Joining a local gym or sports club is a great way to make new friends while keeping in shape.

The average monthly fee for a gym membership or fitness club is around £40.

If you are looking for a basic, no-frills fitness center, check out Fitness Space or Pure Gym for discounted rates.

To rent a tennis court for one hour on a weekend, you will likely pay anywhere from £6 to £20.

To find coed recreational sports groups in London, try Meetup.

Cost of Childcare

If you have children or are planning to have children, childcare and schooling is another thing to consider in addition to your other living expenses.

Depending on if your child will require part-time or full-time childcare, you should be prepared to spend £160 to £330 per week for a registered childminder.

There are many online resources to find the right person to care for your child, such as Childcare, Nannyjob, and Rockmybaby.

For an array of reasons, some people prefer to send their children to private school.

In this case, childcare will be significantly more expensive.

For a full day of preschool at a private school, it will cost around £1,300 per month.

As children get older, private school tuition greatly increases, with fees ranging from 10,000-23,000 per year.

Cost of Shipping Items (to & From London)

Getting your belongings to London from where you currently live is another expense that must be considered.

The less belongings you move with, the cheaper and easier it will be.

But if you have a large family or intend on bringing over many large items, you will need to consider the use of a shipping container.

The cost of a shipping container varies with the distance from which you are moving, but you can expect to pay anywhere from £1,400 to $5,000.

For example, transporting a 20ft shipping container from New York costs around £1,500, and for a 40ft container it will be around £2,000.

It is possible to pay less if you chose to share the shipping container with someone else instead of hiring a private one.

However, if you plan on shipping a vehicle to London, we do recommend having the shipping container to yourself for security reasons.

London Moving & Storage Costs

Some people opt to move before finding permanent residency, and if this is the case, it can be helpful to store your large belongings at a storage facility.

This is also beneficial for those with smaller flats who do not want off-season items in their home all year round. We have the perfect solution to your problem. Rent a storage unit at STORED and increase your storage space instantly.

Depending on the size of the unit, this can cost anywhere from £50-150 per month.

STORED is London’s easiest, most cost-efficient storage facility. With our hassle-free storage service, we make storage convenient for everyone!

We will help you achieve your dream of living in London. Our removal services are designed to make moving a stress-free experience.

Our team is expert in handling all sorts of belongings. We make sure all your belongings reach you in optimal condition. Call us today or book us online, let’s get your moving process started.

We also offer expert moving services to get your belongings to and from wherever you desire, at a time that suits your needs, for a reasonable amount of money.

Other Costs to Consider

In addition to the most obvious living costs, there are other small things to budget for that can sometimes be overlooked.

A mobile phone plan is a necessity in this modern era.

Billmonitor has a calculator that will analyse your needs and find the best phone plan for you. Some plans are as cheap as £19 per month.

Monthly subscriptions such as Netflix, music streaming services, and software programs might seem cheap on their own, but if you have multiple payments every month, this can become quite costly.

If you are on a tight budget, carefully consider which services are most important, and cancel those that are not necessary.

Basic household necessities such as toilet paper and cleaning products, and cosmetic items are comparable to prices in the United States and most other countries, but still, do not forget to factor them into your monthly budget.

Wrapping Up

It is estimated that the average single person living in London will likely spend £793.96 per month excluding rent.

While this is undoubtedly higher than many cities in Europe, London has a lot to offer, and relocating there is not impossible

Millions of people are able to successfully live and work in this capital city, and the population continues to grow every year.

London is a land of opportunities for career advancement, entertainment, and quality of life.

Careful budgeting, research, and compromise will allow you to flourish in this incredible city.

Have you made the exciting move to London? How did you plan for your journey? What budgeting advice would you give to others?

Let us know by leaving a comment below!